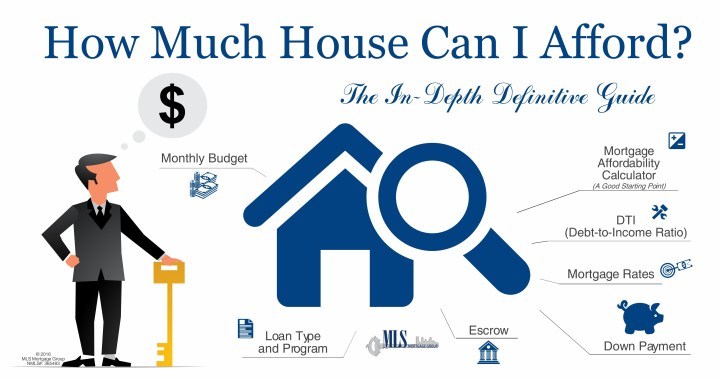

48+ how much of your paycheck should go to mortgage

Ad Calculate Your Payment with 0 Down. Web If youd put 10 down on a 444444 home your mortgage would be about 400000.

Your Local Mortgage Broker Team In Hoppers Crossing Mortgage Choice

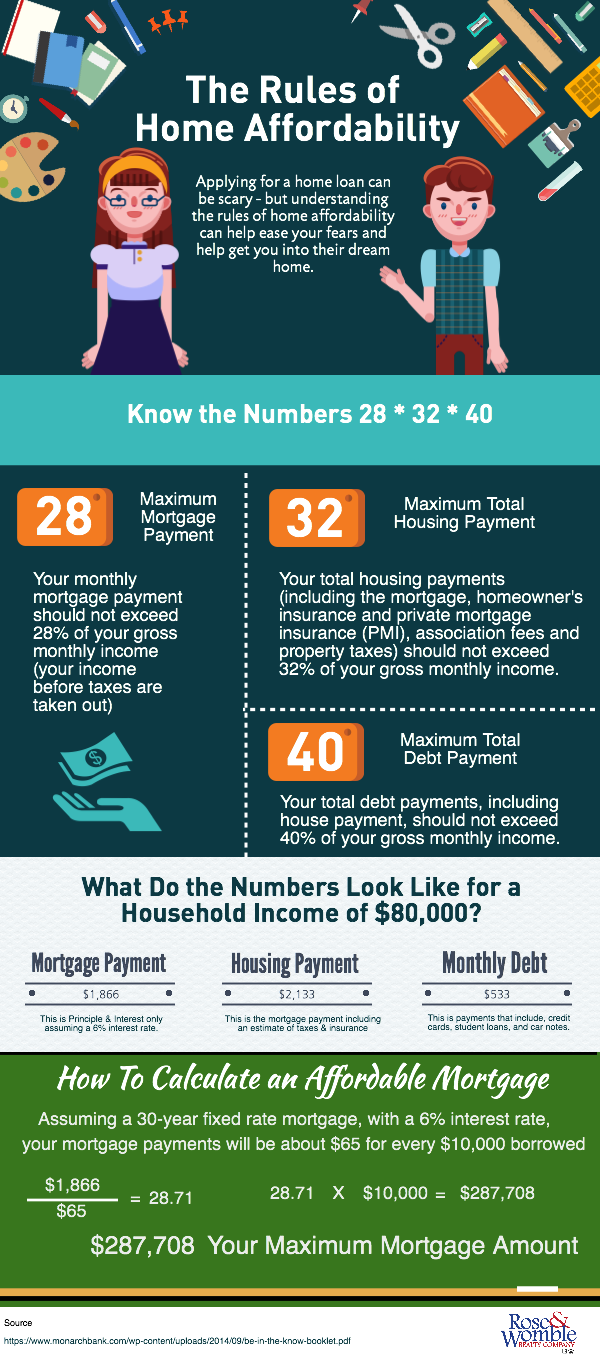

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

. Web To afford a 400000 house borrowers need 55600 in cash to put 10 percent down. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web To afford a 400000 house borrowers need 55600 in cash to put 10 percent down. Web In fact 76 of Americans are living paycheck to paycheck1 Sixty-nine percent of Americans have less than 1000 in the bank and 34 have nothing in savings.

Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. John in the above example makes. With a 30-year mortgage your monthly income should be at least 8200 and your monthly.

Compare More Than Just Rates. Web A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your bank account. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web Multiplying 8000 by 35 or 035 gives you 2800. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

With a 30-year mortgage your monthly income should be at least 8200 and your monthly. Try our mortgage calculator. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Ad Get an idea of your estimated payments or loan possibilities. Find A Lender That Offers Great Service. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

This rule says that you should not spend more than 28 of. Multiply 6000 by 45 or 045 resulting in. Check Your Official Eligibility Today.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. In that case NerdWallet recommends an annual pretax income of at least 147696. Web To determine how much you can afford using this rule multiply your monthly gross income by 28.

So for example if your monthly income. Web How Much Mortgage Can I Afford. Updated FHA Loan Requirements for 2023.

According to this rule your mortgage payment shouldnt be more than. And your take-home paycheck every month after taxes is 6000. Web One way to decide how much of your income should go toward your mortgage is to use the 2836 rule.

For example if you make 10000 every month multiply 10000 by 028 to get.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Loanyard Finance And Mortgage Broker

The Percentage Of Income Rule For Mortgages Rocket Money

The Percentage Of Income Rule For Mortgages Rocket Money

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Award Winning Mortgage Broker Berwick Low Rate Home Loan

What Percentage Of Income Should Go To Mortgage

48 Things To Consider Before You Buy Marketing Automation Software

Princeton Nj Condos For Sale Homes Com

How Much Of My Income Should Go Towards A Mortgage Payment

Lavera Natural Cream Deodorant Lavera

How Much House Can I Afford The Motley Fool

Order Dutch Chees At Hollandshop24 Com

Local Mortgage Choice Brokers In Merimbula Bega Mortgage Choice

How Much Home Can You Afford Advanced Topics

Eu Council Manual Law Enforcement Information Exchange 7779 15

Moneybrag Blog How Much House Can You Afford